- Example

- Assignment Clause

- Conflict of Interest Clause

- Exclusivity Clause

- Indemnification Clause

- Non-Compete Clause

- Non-Solicitation Clause

- Termination Clause

What is a Consultant?

A consultant is a person who gives professional advice in a particular field such as management, marketing, information technology, health care, and other areas of work. Consultants can be hired internally (operating within an organization in a semi-permanent capacity) or externally (appointed by a consulting firm to clients on a temporary basis). The role of a consultant is to assess a company’s current state and report their findings to the client. The consultant will provide their professional opinion regarding the changes that could be made to improve the company’s success by working on their budget, enhancing or developing new services, and increasing overall productivity. It is the client’s choice whether or not they wish to heed the consultant’s advice. The consultant may continue to work with the client to implement the new changes or the client may wish to use in-house employees to carry out the improvements.

How to Become a Consultant

Becoming a consultant usually means you are an expert in a specific business or industry. For example, a real estate consultant is someone who has been in the business 20+ years and has knowledge and experience to give advice. A consultant is usually paid based on their level of experience and demand in the market for their specific service.

Consulting Agreement vs Employment Agreement

The main difference between a consultant agreement and an employment agreement is in the former the individual acts as an independent contractor and the latter the person acts as an employee.

A Consultant Agreement is:

- Services are provided on a 1099 independent contractor basis;

- Withholding taxes are paid by the consultant.

- Consultant is allowed to work on other related projects.

An Employment Agreement is:

- Services are provided on an employee basis.

- Withholding taxes are paid by the employer.

- Employee is prohibited to work on other related projects.

What is a Retainer?

A retainer is a downpayment made by the client as an advance on future services. The consultant will typically have a minimum number of billable hours established that they suggest as a retainer amount. A retainer gives the consultant the freedom to draw from the retainer as they proceed with the services contained within their consulting service agreement. Having accessible funds allows them to do their job effectively and gives them peace of mind knowing they don’t have to chase the client for payment upon the completion of the services. A retainer may or may not be refundable depending on the consultant and the agreement signed by the parties. A retainer agreement is most commonly used when a consultant is in high demand and has many years of experience in their field.

Example

A client hires a tax consultant to review their books to see what types of changes to make. Reviewing the client’s financials will take 100 hours. The tax consultant may require an initial payment for the first 20 hours. The initial payment is the “retainer”.

Recommended Clauses

The list below contains recommended clauses for a consultant agreement between a consultant and the client. The clauses listed are not required but should be addressed in the contract to avoid any disagreements amongst the parties.

- Assignment Clause

- Conflict of Interest Clause

- Exclusivity Clause

- Indemnification Clause

- Non-Compete Clause

- Non-Solicitation Clause

- Termination Clause

Assignment Clause

An assignment clause prevents the transferring of obligations, responsibilities, and rights from the consultant to a third party not included in the agreement. Assignment is only permitted if the client signs an amendment to the agreement stating the consultant’s duties may be designated to another party.

Sample

Assignment and Delegation. Consultant may not assign or subcontract any rights or delegate any of its duties under this Agreement without Client’s prior written approval.

Conflict of Interest Clause

A conflict of interest clause ensures that the consultant does not currently and will not in the future engage in any work that creates a conflict of interest with the company. This protects the company from unfair competition arising from the consultant providing similar services to a company in a similar industry.

Sample

During the term of this Agreement, the Consultant agrees not to engage in any work, paid or unpaid, that creates an actual or potential conflict of interest with the Company.

Exclusivity Clause

An exclusivity clause requires the client to use the consultant as their sole service provider. The client will not be able to hire similar or other companies to help assist or complete the service.

Sample

Exclusive Services Provider. During the term of this Agreement, the Consultant shall be the exclusive provider of the Services. The Client agrees to not seek or accept services from other providers unless the prior written consent is obtained from the Consultant.

Indemnification Clause

An indemnification clause is used to hold the client harmless from any damage, liability, or loss caused by the consultant while they perform their services.

Sample

Consultant shall indemnify and hold Client harmless from any loss or liability arising from performing Services under this Agreement.

Non-Compete Clause

A non-compete clause is added to an agreement to stop the consultant from competing with the client during or after the agreement. Competing is defined as engaging in activities that directly compete with the client’s business. This non-compete provision is usually geographically limited to the area in which the client operates and conducts its business.

Sample

The Consultant agrees not to engage in any activities that would compete with the Client’s business or their customers during the term of this Agreement and for ____ months following its termination. This section is to be geographically limited to areas and locations that the Client operates and conducts its business activity.

Non-Solicitation Clause

A non-solicitation clause prevents the client from soliciting the client’s customers (current or prospective) or employees and contractors.

Sample

The Consultant agrees not to solicit any of the Client’s customers, employees, or contractors during the term of this Agreement and for ____ months following its termination.

Termination Clause

The termination clause sets forth the rules for terminating the consulting agreement. It is up to the parties to decide whether or not they wish to allow termination of the agreement. If termination of the agreement is permitted, a specified time period is sometimes applied to give the non-terminating party notice.

Sample

With reasonable cause, either Client or Consultant may terminate this Agreement at any time by giving ____ days’ notice to the other party of the intent to terminate.

How To Write

1 – Acquire This Paperwork To Solidify A Consulting (Service) Agreement

Review the information on this site then direct your attention to the buttons coupled with the preview image of this agreement. You can use either button to access the file location for this agreement as an “Adobe PDF” or Microsoft Word” document (respectively).

2 – Introduce This Agreement And Both Participating Parties

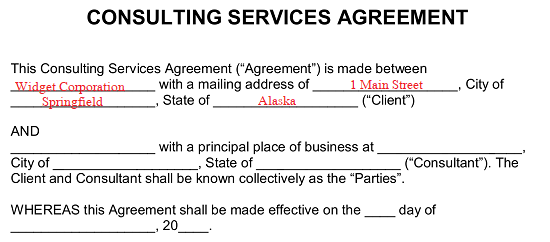

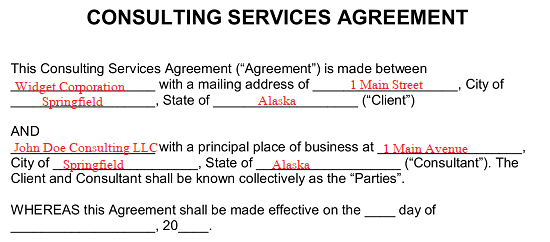

Once you have opened this paperwork as a PDF or Word document, locate the first paragraph. This statement will be divided into a few portions each requiring your input. The first blank line, after the phrase “…Is Made Between” and “With A Mailing Address…” requires you furnish the legal name of the Client for display. The three available lines immediately following the Client’s name expect that you submit the Client’s mailing address as a street address, city, and state where requested.  The second portion of this statement seeks to identify the Consultant in this agreement. Submit the Consultant’s name on the first line after the capitalized word “And” along with his or her address across the next three lines seeking content.

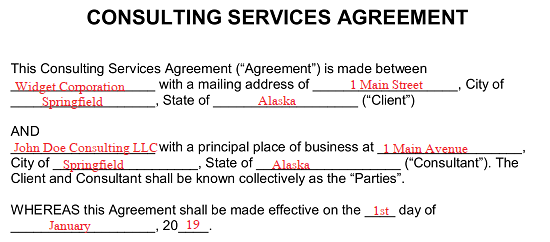

The second portion of this statement seeks to identify the Consultant in this agreement. Submit the Consultant’s name on the first line after the capitalized word “And” along with his or her address across the next three lines seeking content.  Lastly, this introduction will need to declare the official start of this agreement by date. To this end, locate the second sentence in this area (beginning with the word “Whereas…”) then, use it to display the first calendar date when the Consultant and Client will be expected to uphold the contents of this paperwork. Three empty lines have been placed in this sentence so you may record the month, calendar day, and year in separate areas.

Lastly, this introduction will need to declare the official start of this agreement by date. To this end, locate the second sentence in this area (beginning with the word “Whereas…”) then, use it to display the first calendar date when the Consultant and Client will be expected to uphold the contents of this paperwork. Three empty lines have been placed in this sentence so you may record the month, calendar day, and year in separate areas.

3 – Begin The Documenting The Consultation Job By Defining Some Basics

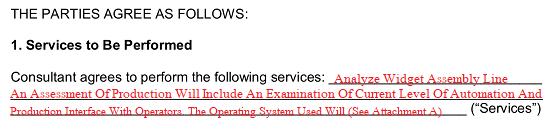

This agreement will be divided by article. Some will require your input while others will have a language set for the goal of this document. The first article that requires attention, “1. Service To Be Performed,” provides a free-form area where you can define the exact consultation services that must be provided by the Consultant. You may add more blank lines with your editing program if there is not enough room or you may even furnish an attachment that you cite here by title and date. However, if you decide to present this information be sure to give a concise but definitive account of the Consultant’s duties for this job.  The second article, titled “2. Payment,” allows a continuation of the description above by seeking documentation of the Client’s obligation of payment. Utilize the area this article presents after the term “…In The Following Manner” to define how his or her payment for the consultation services above will be delivered to the Consultant. This area may include the specifics of a payment plan if appropriate. Notice, just below this area will be some additional requirements placed on the Consultant to gain payment through the method(s) defined.

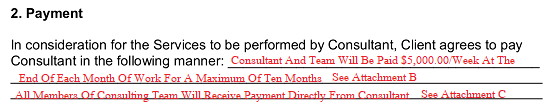

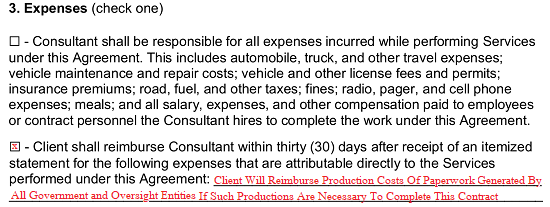

The second article, titled “2. Payment,” allows a continuation of the description above by seeking documentation of the Client’s obligation of payment. Utilize the area this article presents after the term “…In The Following Manner” to define how his or her payment for the consultation services above will be delivered to the Consultant. This area may include the specifics of a payment plan if appropriate. Notice, just below this area will be some additional requirements placed on the Consultant to gain payment through the method(s) defined.  One more basic understanding that should be established at the start of such an agreement concerns the matter of expenses. Two checkbox statements make up the third article (“3 Expenses”). Each one will take a different assumption of who shall pay for expenses that result from the consultation job but not necessarily part of the job (i.e. taxes, administrative fees, transportation, etc.). If the Consultant will be expected to pay for all expenses required to complete this job, then mark the first checkbox (“Consultant Shall Be Responsible”). However, if the Client will reimburse the Consultant for such expenses then mark the second checkbox and list each expense the Client will pay for on the blank lines provided. Notice, in the example below the Client will pay for production fees incurred when requesting an official document from the State or Federal Government.

One more basic understanding that should be established at the start of such an agreement concerns the matter of expenses. Two checkbox statements make up the third article (“3 Expenses”). Each one will take a different assumption of who shall pay for expenses that result from the consultation job but not necessarily part of the job (i.e. taxes, administrative fees, transportation, etc.). If the Consultant will be expected to pay for all expenses required to complete this job, then mark the first checkbox (“Consultant Shall Be Responsible”). However, if the Client will reimburse the Consultant for such expenses then mark the second checkbox and list each expense the Client will pay for on the blank lines provided. Notice, in the example below the Client will pay for production fees incurred when requesting an official document from the State or Federal Government.

The bottom of the first page (and each page following) will need the initials of both the Client and the Consultant to solidify each one’s approval of the information presented.

4 – Review The Groundwork For This Agreement Then Discuss The Contractor Status

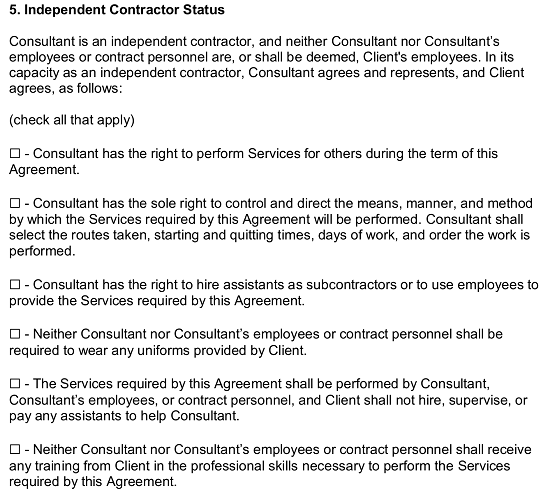

The fifth article (“Independent Contractor Status”) is the next portion of this agreement that requires some definitions to be provided. Here we will discuss some basic autonomy rights that may or may not be retained by the Consultant as an entity contracted by the Client. Several checkbox statements will aid you in describing this status accurately, you will need to review each one then decide whether to mark the checkbox associated with it. If the statement does not apply to the Consultant during this agreement (and thus does not need to be upheld here) then do not mark it. Begin with the first statement.  If the Consultant may continue or even start other consultation jobs while still working for this Client, then mark the first checkbox. If not, then leave it unmarked.

If the Consultant may continue or even start other consultation jobs while still working for this Client, then mark the first checkbox. If not, then leave it unmarked.  If the Consultant will be given the right to take control of the project being worked on as a director or manager, then mark the second checkbox.

If the Consultant will be given the right to take control of the project being worked on as a director or manager, then mark the second checkbox.  In some cases, other contractors may be needed to complete the job. The third checkbox should be marked should Consultant retain the “…Right To Hire Assistants As Subcontractors” or to use the Client’s employees to aid in the completion of this job. If the Consultant should not be given this ability through this agreement, then leave this checkbox blank.

In some cases, other contractors may be needed to complete the job. The third checkbox should be marked should Consultant retain the “…Right To Hire Assistants As Subcontractors” or to use the Client’s employees to aid in the completion of this job. If the Consultant should not be given this ability through this agreement, then leave this checkbox blank.  The fourth checkbox statement of this list should be marked if the Consultant (along with his or her Employees) are exempt from any uniform regulations or dress code criteria the Client requires his or her Employees to adhere to. If the Consultant and his or her staff must follow the same dress criteria that the Client’s employees are expected to follow, then leave this checkbox blank.

The fourth checkbox statement of this list should be marked if the Consultant (along with his or her Employees) are exempt from any uniform regulations or dress code criteria the Client requires his or her Employees to adhere to. If the Consultant and his or her staff must follow the same dress criteria that the Client’s employees are expected to follow, then leave this checkbox blank.

If the Consultant Services that are defined by this agreement may only be engaged in and completed by the Consultant (and his or her Employees) and no other party (even one hired by the Client after the date of this contract) then mark the fifth checkbox statement. If the Client may continue to commission outside parties to complete the some or all the services, this contract places on the Consultant then leave this checkbox unedited.  Mark the seventh statement if the consultation job should be completed without any Client provided training to the Consultant and his or her team. If the Client is expected to provide the Consultant and team with training to perform and/or complete the services required, then leave this statement unmarked.

Mark the seventh statement if the consultation job should be completed without any Client provided training to the Consultant and his or her team. If the Client is expected to provide the Consultant and team with training to perform and/or complete the services required, then leave this statement unmarked.  If the Client does not expect the Consultant and his or her team to work exclusively on the concerned project, then mark the final checkbox. If this will be a requirement of the Client, then mark this final checkbox statement.

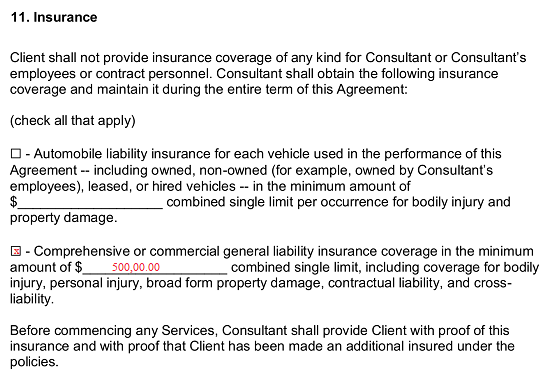

If the Client does not expect the Consultant and his or her team to work exclusively on the concerned project, then mark the final checkbox. If this will be a requirement of the Client, then mark this final checkbox statement.  Now, direct your attention to article “11. Insurance.” In many cases, the Client will require that only properly insured vehicles be used to drive onto the Client property or even drive to the Client property when working on this project. This section contains two statements to describe what is required to fulfill such a requirement. You may mark one, both, or neither depending upon the agreement being documented. If the Client requires that “Automobile Liability Insurance” be carried for each vehicle the Consultant and team will use to drive to, access, or visit any property while working on this project, then mark the first checkbox and report the “Combined Single Limit Per Occurrence For Bodily Injury And Property Damage” amount on blank line available.

Now, direct your attention to article “11. Insurance.” In many cases, the Client will require that only properly insured vehicles be used to drive onto the Client property or even drive to the Client property when working on this project. This section contains two statements to describe what is required to fulfill such a requirement. You may mark one, both, or neither depending upon the agreement being documented. If the Client requires that “Automobile Liability Insurance” be carried for each vehicle the Consultant and team will use to drive to, access, or visit any property while working on this project, then mark the first checkbox and report the “Combined Single Limit Per Occurrence For Bodily Injury And Property Damage” amount on blank line available.  Similarly, if the Consultant is required to carry “Comprehensive Or Commercial General Liability Insurance then mark the second checkbox and report the dollar value of the minimum combined single limit amount on the blank line provided.

Similarly, if the Consultant is required to carry “Comprehensive Or Commercial General Liability Insurance then mark the second checkbox and report the dollar value of the minimum combined single limit amount on the blank line provided.

5 – Address This Agreement’s Stability

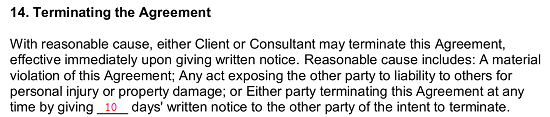

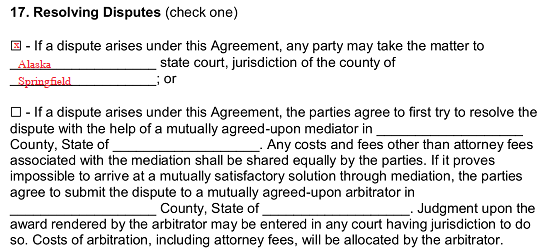

Look for the fourteenth article displayed with the bold words “Terminating The Agreement.” The statement contained here allows either party to end the effectiveness of this contract upon a reasonable cause. Read this statement carefully then, record the number of “Days’ Written Notice” the terminating Party must provide to the remaining one on the empty line of this statement.  The next two articles (“15. Exclusive Agreement” and “16. Modifying The Agreement”) document how durable this paperwork is. Read these items carefully. Then check one of the statements in “17. Resolving Disputes” to indicate how a disagreement regarding the terms of this contract may be handled. If both parties agree that a dispute should be settled in court, then mark the first statement’s checkbox and declare the state and county whose jurisdiction will apply to the two blank lines.

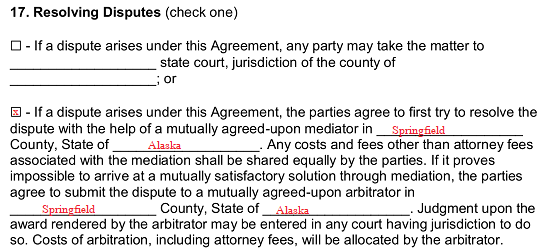

The next two articles (“15. Exclusive Agreement” and “16. Modifying The Agreement”) document how durable this paperwork is. Read these items carefully. Then check one of the statements in “17. Resolving Disputes” to indicate how a disagreement regarding the terms of this contract may be handled. If both parties agree that a dispute should be settled in court, then mark the first statement’s checkbox and declare the state and county whose jurisdiction will apply to the two blank lines.  If both parties agree that disputes can be handled by a Mediator and, if failing that, an Arbitrator, before seeking a resolution in court then, mark the second checkbox. Keep in mind you must provide the county and state of mediation to the first two blank lines and the county and state arbitration on the last two empty lines.

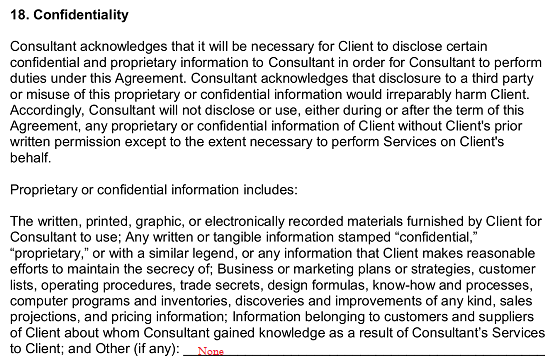

If both parties agree that disputes can be handled by a Mediator and, if failing that, an Arbitrator, before seeking a resolution in court then, mark the second checkbox. Keep in mind you must provide the county and state of mediation to the first two blank lines and the county and state arbitration on the last two empty lines.  The section titled “18. Confidentiality” will define what restrictions on the Consultant’s behavior concerning the Client’s proprietary information or confidential information and what may fall under both categories. There is also a blank line following the words “…And Other (If Any)” that will accept additional definitions to accurately protect the Client’s proprietary and confidential information. If no other definitions are needed, it may be left blank.

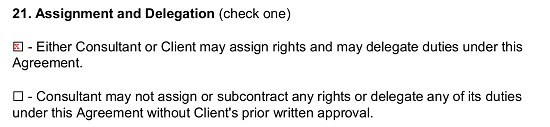

The section titled “18. Confidentiality” will define what restrictions on the Consultant’s behavior concerning the Client’s proprietary information or confidential information and what may fall under both categories. There is also a blank line following the words “…And Other (If Any)” that will accept additional definitions to accurately protect the Client’s proprietary and confidential information. If no other definitions are needed, it may be left blank.  In “21. Assignment And Delegation,” you must indicate if either both the Consultant and Client may delegate the duties of this contract by marking the first checkbox or if only the “Consultant May Not Assign Or Subcontract” any contractual duties by marking the second choice. Notice in the example below that both parties will be given the ability to assign the necessary rights to complete tasks called for by this contract.

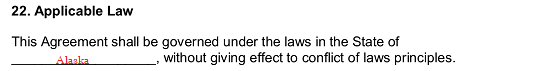

In “21. Assignment And Delegation,” you must indicate if either both the Consultant and Client may delegate the duties of this contract by marking the first checkbox or if only the “Consultant May Not Assign Or Subcontract” any contractual duties by marking the second choice. Notice in the example below that both parties will be given the ability to assign the necessary rights to complete tasks called for by this contract.  We must name the state whose laws will be used to govern and enforce this contract. For this task, refer to article “22. Applicable Law” then fill in the name of this state on the blank line attached to the phrase “…The State Of”

We must name the state whose laws will be used to govern and enforce this contract. For this task, refer to article “22. Applicable Law” then fill in the name of this state on the blank line attached to the phrase “…The State Of”

6 – Finalize This Contract And Its Contents By Signature

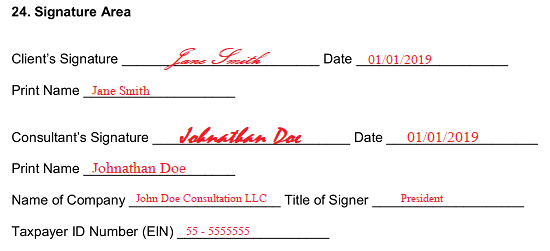

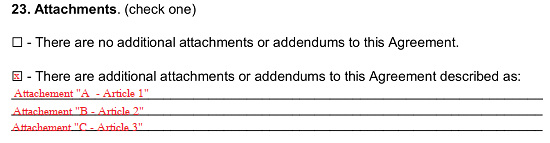

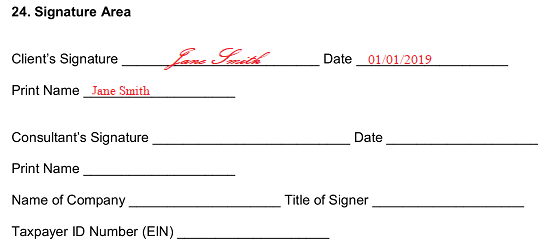

The next article will be the final one requiring definition. You must confirm if this contract contains all the agreements the Consultant and Client agree to be bound to or if additional documents will provide further definitions, provisions, restrictions, etc. If this is a standalone document with no attached paperwork, then mark the first checkbox in “23. Attachments.” However, if this contract requires additional paperwork to fully represent the agreement being made and this paperwork must be attached and considered part of this contract then, mark the second checkbox of article 23. You must also list each attachment by name (even if you have done so above already) and date. It is recommended each party initial each attachment.  The last article of this agreement (“24. Signature Area”) will expect both parties to verify their intention of upholding and carrying out the terms of the document we have just completed by signing their names. The first signature line is devoted to the Client. He or she must sign the “Client’s Signature” line then enter the signature date. Just below this, the Signature Party must print his or her name on the “Print Name” line

The last article of this agreement (“24. Signature Area”) will expect both parties to verify their intention of upholding and carrying out the terms of the document we have just completed by signing their names. The first signature line is devoted to the Client. He or she must sign the “Client’s Signature” line then enter the signature date. Just below this, the Signature Party must print his or her name on the “Print Name” line  Below this the Consultant must also formally enter this agreement by signing the “Consultant’s Signature” line. This signature must be accompanied by the signature “Date” and the Consultant’s printed name (“Print Name”). Notice that below this area, the entity name of the Consultant’s company must be entered on the line “Name Of Company,” the “Title Of Signer” in this company along with its “Taxpayer ID Number (EIN)” must also be presented where requested by the individual signing the Consultant’s Signature.

Below this the Consultant must also formally enter this agreement by signing the “Consultant’s Signature” line. This signature must be accompanied by the signature “Date” and the Consultant’s printed name (“Print Name”). Notice that below this area, the entity name of the Consultant’s company must be entered on the line “Name Of Company,” the “Title Of Signer” in this company along with its “Taxpayer ID Number (EIN)” must also be presented where requested by the individual signing the Consultant’s Signature.