The Closing Disclosure gives the final terms and costs of a mortgage as you near the financing finish line.

Updated Mar 6, 2024 · 2 min read Written by Barbara Marquand Senior Writer Barbara MarquandBarbara Marquand is a former NerdWallet writer covering mortgages, homebuying and homeownership, insurance and investing. Previously, she covered personal finance for QuinStreet and wrote for national consumer and trade publications on topics including business, careers and parenting. Her work has appeared in MarketWatch, MSN Money, The New York Times and The Washington Post.

Reviewed by Michelle Blackford Michelle Blackford

Michelle Blackford spent 30 years working in the mortgage and banking industries, starting her career as a part-time bank teller and working her way up to becoming a mortgage loan processor and underwriter. She has worked with conventional and government-backed mortgages. Michelle currently works in quality assurance for Innovation Refunds, a company that provides tax assistance to small businesses.

At NerdWallet, our content goes through a rigorous editorial review process. We have such confidence in our accurate and useful content that we let outside experts inspect our work.

Assistant assigning editor at large Dawnielle Robinson-Walker

Assistant assigning editor at large | McGraw Hill, Hallmark Cards, Forbes Health

Dawnielle Robinson-Walker spent 16 years as a college English instructor, teaching creative writing and African-American literature before she began writing and editing for various companies and online publications. Prior to joining NerdWallet, she was an editor at Hallmark Cards and a contributing writer at Forbes Health.

Fact Checked

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

A few days before you're scheduled to close on a mortgage, the lender will provide a Closing Disclosure. Review this document carefully and ask questions if there's anything that you don't understand.

The Closing Disclosure is a five-page form that spells out the final terms and closing costs of a home loan.

Your lender must provide the Closing Disclosure at least three business days before the scheduled loan closing. This gives you time to review everything and ask questions before signing forms at the closing table.

Go through the Closing Disclosure line by line. Compare the information on the Closing Disclosure with that on the Loan Estimate — the document the lender provided shortly after you applied for the mortgage.

Did you know.The Loan Estimate is a document that gives estimated costs of a home loan. You should receive a Loan Estimate from the lender within three business days of applying for a mortgage.

If any information looks different from what you expected, contact the lender or settlement agent right away.

The first page of the Closing Disclosure gives the loan amount, interest rate, closing costs and the amount of cash needed at closing. The second page spells out the closing cost details.

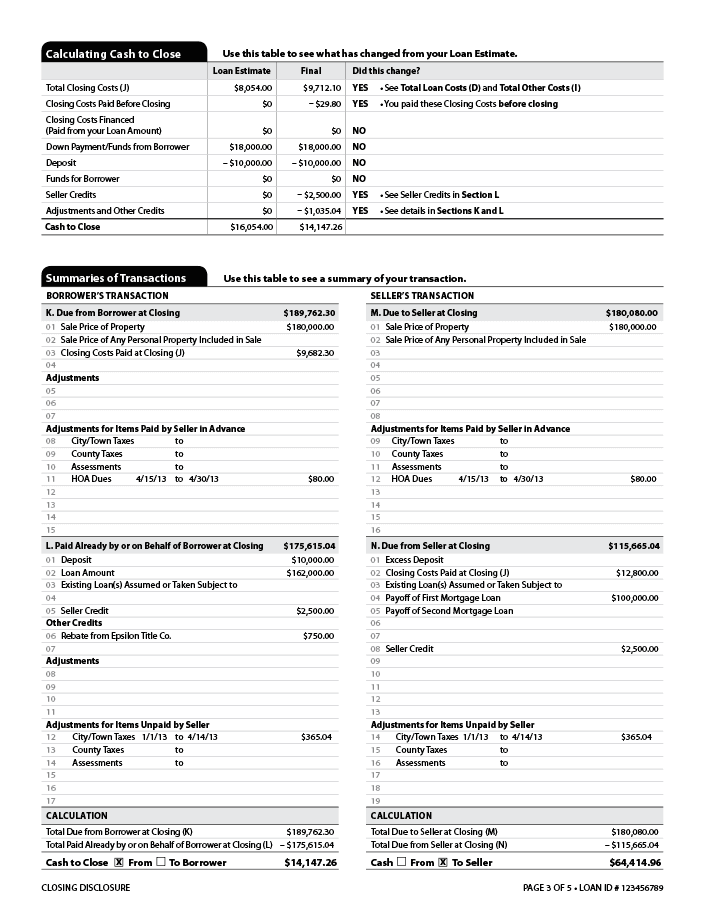

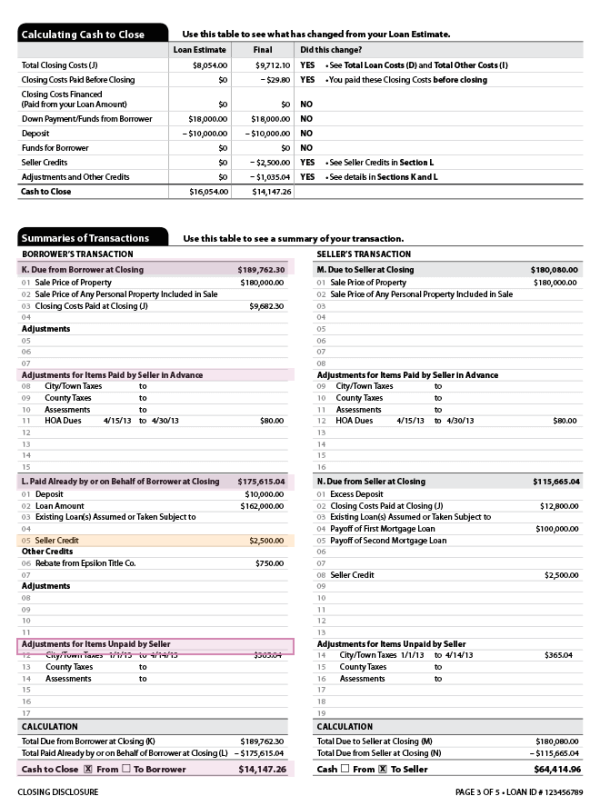

Pay special attention to the third page, which features a comparison table showing the costs as reported by the Loan Estimate and the actual charges to be applied at closing. This section clearly shows whether the costs have changed since receiving your Loan Estimate.

At the bottom is the literal bottom line — the total amount you, as the borrower, will owe at closing. The image below is from a sample Closing Disclosure on the Consumer Financial Protection Bureau's website , where you can click through each page of the form for more detail.

The fourth page shows how the cash-to-close is calculated and the summary of the transaction, and the fifth page provides additional information about the loan, such as escrow account details.

Any substantial revision to the loan’s terms triggers a new three-day review. Minor changes such as modifications to the escrow or adjustments to prorated payments for taxes, utilities and the like don’t qualify.

These three things can reset the 72-hour clock:

The APR increases by more than one-eighth of a percentage point for fixed-rate loans or more than one-quarter of a percentage point for adjustable-rate mortgages.

A prepayment penalty is added to the loan terms.The loan product changes , such as moving from a fixed-rate to an adjustable-rate loan or to an interest-only mortgage.

The Closing Disclosure may look official — and maybe a little intimidating at first. But don't assume the document is correct, advises the Consumer Financial Protection Bureau. Mistakes can happen, which is why it's critical that you review closing documents carefully and contact your lender or settlement agent if anything seems awry.

About the authorYou’re following Barbara Marquand

Visit your My NerdWallet Settings page to see all the writers you're following.

Barbara Marquand is a former NerdWallet writer covering mortgages, homebuying and homeownership. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105