Itemizing is a way to pick and choose your tax deductions. Here's how it works and how to tell if it's for you.

Updated Mar 13, 2024 · 2 min read Written by Tina Orem Assistant Assigning Editor Tina Orem

Assistant Assigning Editor | Taxes, small business, Social Security and estate planning, home services

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Co-written by Sabrina Parys Assistant Assigning Editor Sabrina Parys

Assistant Assigning Editor | Taxes, Investing

Sabrina Parys is an assistant assigning editor on the taxes and investing team at NerdWallet, where she manages and writes content on personal income taxes. Her previous experience includes five years as a copy editor and associate editor in academic and educational publishing. She is based in Brooklyn, New York.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeawaysFor some taxpayers, itemizing on a tax return can make a huge difference in their tax bill. But itemized deductions aren't necessarily no-brainers.

Here are some things you need to know about what itemized deductions are, and what it means to itemize on your tax return.

Need to skip ahead? Jump to:

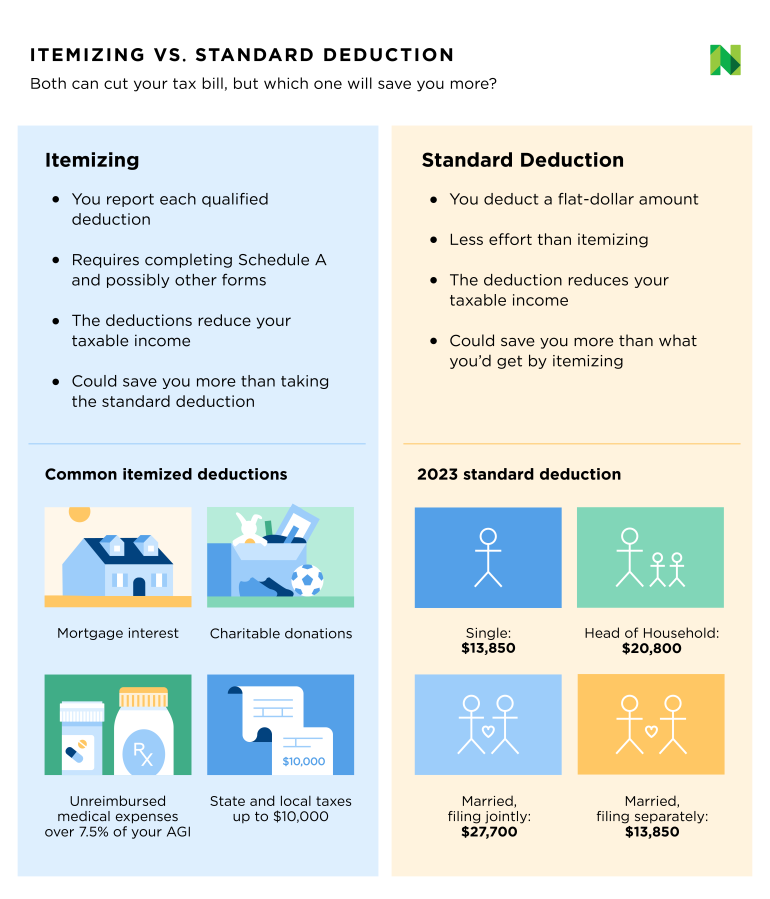

Itemized deductions are certain expenses allowed by the IRS that can decrease your taxable income (aka the amount of your income that's subject to taxes).

When you itemize on your tax return, you opt to pick and choose from the multitude of individual tax deductions out there instead of taking the flat-dollar standard deduction.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

Hassle-free tax filing* is $50 for all tax situations — no hidden costs or fees.Maximum refund guaranteed

Get every dollar you deserve* when you file with this tax product, powered by Column Tax. File up to 2x faster than traditional options.* Get your refund, and get on with your life.*guaranteed by Column Tax

There are many types of itemized deductions, but claiming them can be complicated. Each type of deduction usually has its own set of rules about who and what qualifies, so make sure to learn more about each benefit to understand if it makes sense for your situation.

Here are a few of the most common itemized deductions:

The IRS lets taxpayers deduct a certain percentage of unreimbursed medical and dental expenses they've amassed throughout the year. The keyword here is unreimbursed: to qualify, expenses must have been paid for out of pocket, meaning your insurance could not have covered them or reimbursed you for them. These types of expenses can include prescription drugs, payments to doctors, hospital care, dentures and more.

Homeowners who are subject to high property taxes can take advantage of what's known as the SALT deduction, which allows them to write off up to $10,000 in property taxes and either local state and local income taxes or sales taxes .

Taxpayers who have a home mortgage can take advantage of this itemized deduction that allows them to reduce taxable income each year they pay interest toward the loan. The deduction is capped at the first $750,000 of mortgage debt for either your main or second home. For those who are married but file separately, the limit of deductible mortgage interest is capped at the first $375,000. Plus there are different rules for mortgages before December 2017.

Contributions made to IRS-recognized charities are considered deductible expenses. How much you are able to deduct depends on the type of contribution made, but typically it ranges from 20% to 60% of your adjusted gross income (AGI) .

Itemized deductions might add up to more than the standard deduction. The more you can deduct, the less you’ll pay in taxes, which is why some people itemize — the total of their itemized deductions is more than the standard deduction.

Some situations make itemizing especially attractive. If you own your home, for example, your itemized deductions for mortgage interest and property taxes may easily exceed the standard deduction, saving you money.

You have to understand the rules. As mentioned earlier, some itemized deductions come with a few hurdles. If you have medical expenses, for example, you can only deduct the portion that exceeds 7.5% of your adjusted gross income.

You might have to spend more time on your tax return. If you itemize, you’ll need to set aside extra time when preparing your returns to fill out Form 1040 and Schedule A , as well as the supporting schedules that feed into those forms.

You need proof. You need to be able to substantiate your deductions. That means keeping records and being organized. If you normally take the standard deduction and are thinking of itemizing when preparing your return next year, start saving your receipts and other proof for your deductions now.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

Register Nowfor a NerdWallet account

The standard deduction is basically a flat-dollar, no-questions-asked reduction in your adjusted gross income. When you take the standard deduction, you essentially opt to take a flat-dollar deduction instead of picking and choosing from the multitudes of individual tax deductions out there.

Here are some big reasons people take the standard deduction instead of itemizing on their tax returns.

It's faster. Taking the standard deduction makes the tax-prep process relatively quick and easy, which probably is one reason most taxpayers take the standard deduction instead of itemizing.

It usually gets bigger every year. Congress sets the amount of the standard deduction, and it’s typically adjusted every year for inflation .

Some people get more (or less). The standard deduction is higher for people 65 or older and/or blind, though filing status is still a factor. And if someone can claim you as a dependent, you get a smaller standard deduction.

You can’t take the standard deduction if you’re married but filing separately and your spouse chooses to itemize. You both have to do the same thing — either itemize or take the standard deduction.

If your standard deduction is less than your itemized deductions, you should consider itemizing to save money. If your standard deduction is more than your itemized deductions, it might be worth it to take the standard and save some time.

If you’re using tax software , it’s probably worth the time to answer all the questions about itemized deductions that might apply to you. Why? The software or your tax preparer can run your return both ways to see which method produces a lower tax bill. Even if you end up taking the standard deduction, at least you’ll know you’re coming out ahead.

You’re following Tina Orem

Visit your My NerdWallet Settings page to see all the writers you're following.

Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. See full bio.

You’re following Sabrina Parys

Visit your My NerdWallet Settings page to see all the writers you're following.

Sabrina Parys is a content management specialist on the taxes and investing team at NerdWallet, where she manages and writes content on personal income taxes. Her work has appeared in The Associated Press, The Washington Post and Yahoo Finance. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105