Experience modifiers (Emod's) are an objective methodology of rewarding or penalizing a business based on premium and claims. The mod rate assigned to a business will be universally applied to policy pricing regardless of which insurance company quotes the coverage. All new businesses start with an experience modification rate of 1.00 because they have no prior premium or claims to merit an Emod. The factor compares your loss data to other employers in the same class codes, and is expressed as a credit or debit on your policy.

Emod Questions? Call 888-611-7467 for a Workers Compensation SpecialistWorkers compensation insurance experience rating is a mandatory program designed to measure and rate the risk of individual companies against other businesses in the same industry. Experience rating compares an employer's actual claims experience to the expected or average experience of all similar business types within a state.

An experience modification is developed and applied to risks with premium large enough for the insured's past experience to be an indicator of how much benefit, or claims, costs will be paid on behalf of the insured in the future. If an employer's past experience is better or worse than average, his premium is adjusted downward or upward by the application of the Emod, respectively.

In general, employer experience rating refers to a record of premiums and losses over the course of all applicable prior work comp polices. This provides a basis to predict future rates or costs for insurance carriers.

An employers' experience modification rate refers the factor calculated from actual loss experience amd used to adjust an the businesses manual premiums (higher or lower) based on the businesses loss experience relative to the average underlying manual premiums. The Modifier (X-mod) compares the insured experience to the average class experience.

Business owners and insurance agents use numerous interchangeable terms when referring to their experience modification rate. Synonyms include: EMT Rating, X-mod, Emod, ncci credit, mod rate, experience modification factor, ncci worksheet and EMR number.

The intent and purpose of experience rating is to incentivize business owners to take meaningful actions to reduce and prevent injuries. Workers comp manual rates group employers by their class codes, but that does not differentiate a business with no claims from a business averaging several claims a year. The business with no claims should pay less for coverage. The business with more claims should pay a larger share of the premium needed to provide for the cost of the claims.

As an example, the state of Missouri has a one year threshold of $7,000 in premium before a business will be assigned and Emod and a Rating Effective Date (RED). Otherwise, the business will need premium to exceed $3,500 for more than two policy periods before it can qualify for an EMR rating. Each state sets their own dollar value for x-mod qualification.

Who Calculates Experience Ratings?

NCCI administers workers' compensation experience rating for 39 states. All business owners have a right to request their experience modification rate worksheet from NCCI or their state authority. States that administer their own EMR Rating programs include:

| California | Workers' Compensation Insurance Rating Bureau- WCIRB |

|---|---|

| Delaware | Delaware Compensation Rating Bureau- DCRB |

| Indiana | Indiana Compensation Rating Bureau- ICRB |

| Massachusetts | Workers' Compensation Rating and Inspection Bureau |

| Michigan | Compensation Advisory Organization of Michigan- CAOM |

| Minnesota | Minnesota Workers' Compensation Insurers Association- MWCIA |

| New Jersey | New Jersey Compensation Rating and Inspection Bureau- NJCRIB |

| New York | New York Compensation Insurance Rating Board- NYCIRB |

| North Carolina | North Carolina Rate Bureau- NCRB |

| North Dakota | Monopolistic |

| Ohio | Monopolistic |

| Pennsylvania | Pennsylvania Compensation Rating Bureau- PCRB |

| Texas | Texas Department of Insurance- TDI |

| Washington | Monopolistic |

| Wisconsin | Wisconsin Compensation Rating Bureau- WCRB |

| Wyoming | Monopolistic |

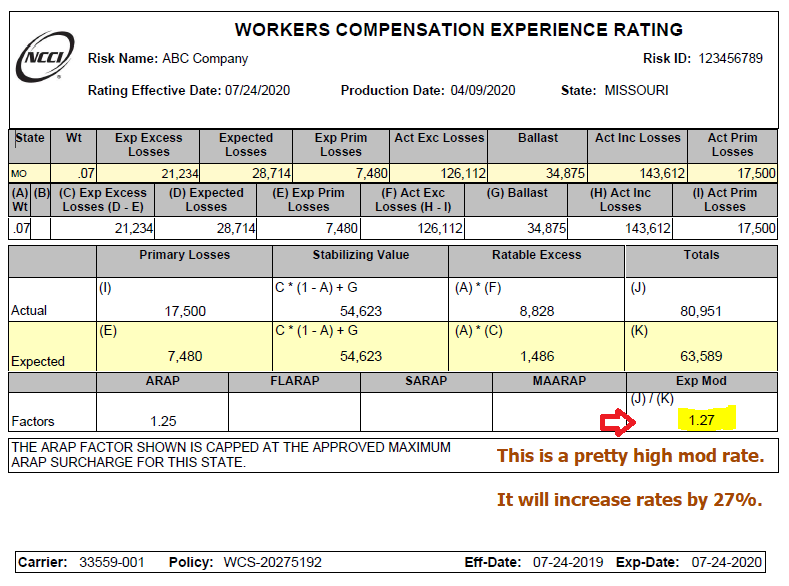

Here's Example of an NCCI Worksheet

The workers comp experience modification worksheet is a summary of claims and losses. It indicates how expected losses compare to actual losses over a period of time. Each year, qualifying businesses will receive a new Emod worksheet about 90 days prior to their Rating Effective Date.

A modification factor is a factor applied to the policy premium for a risk to reflect variation from the experience of the average risk of a similar type. From the risk's own past experience, the experience modification rate is determined by comparing actual losses to expected losses. This comparison of future losses results in a premium reduction (credit) or a premium increase (debit).

For example, a modification of .85 results in a 15% credit or savings to the risk, while a modification of 1.10 produces a 10% debit or additional charge to the risk. In some cases, no change results and a modification of 1.00 (unity) is applied.

In computing insurance premiums, experience modification factor refers to a provision for premium adjustment that recognized the merits or demerits of individual risks.

The modifier or "Emod" is a factor calculated from actual case loss experience, as reported on the unit statistical reports, used to adjust an insured's manual premiums (up or down). It compares the insured's experience to average class experience related to the same industries.

Workers' Compensation CLaims Costs- 3 Categories: